Anand Chakravarti

Area Vice President – MEA and APAC, Pivot3

Current Practices, Priorities & Purchase Drivers

Video surveillance is a fact of modern day life and an integral part of most security operations. In developed areas, video surveillance seems so ubiquitous that it can almost be surprising when there is no video record that relates to an event of interest.

From the first use of closed caption video – Germany capturing the firing of V-2 rockets during World War II – to today’s mobile, tiny drone cameras, the steady and staggering march of technology has seen the use and purpose of video surveillance changing over the years. What started as live monitoring evolved as systems, and storage solutions has evolved to be as much, if not more, about investigations where captured footage was analyzed for clues or proof. The potential of artificial intelligence enhances both live-monitoring and investigative purposes of video surveillance, and the market for video surveillance equipment continues its steep slope upward. Technology research firm IHS Markit estimated 10 million surveillance cameras were shipped in 2006. The number of new cameras shipped topped 100 million in 2016 and was more than 130 million in 2018.

In this environment, Security Management magazine, together with Pivot3, a leading provider of intelligent infrastructure solutions for video surveillance, surveyed the security sector to gain an understanding of the current practice and trends in video surveillance.

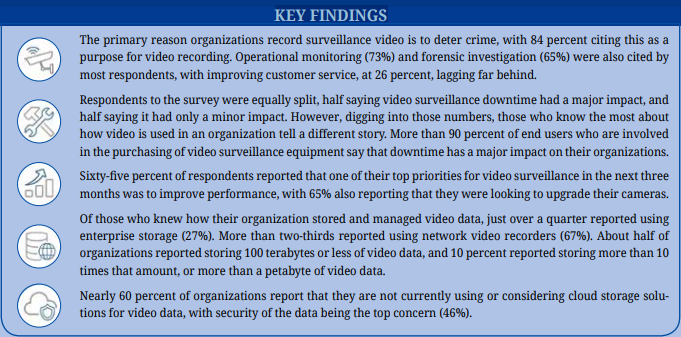

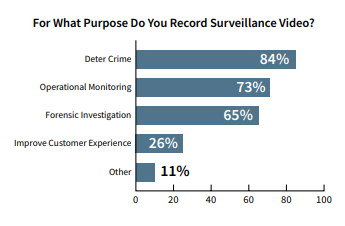

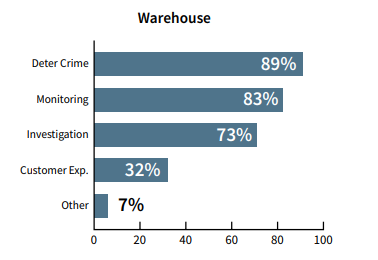

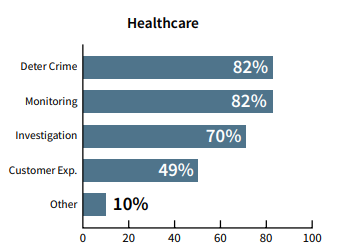

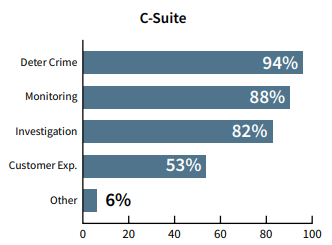

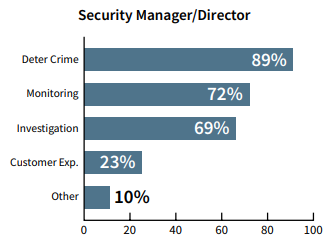

Purpose for recording surveillance video

Deterring crime, forensic investigation and operational monitoring were all cited heavily as reasons to record video surveillance, with improving customer service not seen by most security professionals as a reason. Many of the reasons given when respondents chose ‘other’ can be seen as specialized cases of the broader categories. For example, a few cited safeguarding their employees or something similar, which could fall under deterring crime; others cited post-incident evidence, which could fall under forensic investigation. Another category cited often was compliance with standards or regulations.

In a post-survey interview, Steve Lindsey, Senior Director, Corporate Security at the University of Phoenix who previously worked in security for Walmart, noted that video surveillance was a tool primarily for deterring crime and forensic investigation.

“We have a number of cameras that are designed to capture individuals coming in the main doors, in high-traffic areas, and some high-value target areas such as data closets. With the exception of guard staff monitoring video of parking areas, there’s not a lot of active monitoring. Video is used to investigate a wide variety of claims from accidents to theft to access areas. If something happens, you go back to the video and it helps to fill out the story of what happened,” commented Steve.

At the large agricultural products and services company Cargill, which has hundreds of locations throughout the world, video is increasingly used for operational monitoring according to Global Asset Security Manager Joel Martin. He said, “We’re seeing a convergence of physical security and operations. For example, we’re working to develop an algorithm where the camera will detect if someone is not wearing a yellow safety vest in a certain area, and once detected it sends a signal to a loudspeaker that will alert the person that a safety vest is required while in the area.”

When cross-tabulating the purposes cited for recording video surveillance with organizational and individual demographics – deterring crime, forensics and operational monitoring remained the top reasons across all segments – at remarkably similar totals to the overall results. In a few segments, the percentage which cited improving customer service rose above 50 percent – including C-suite responders (53%) as well as those in the healthcare (49%), and sports and entertainment (51%) sectors.

The importance of video to the organization

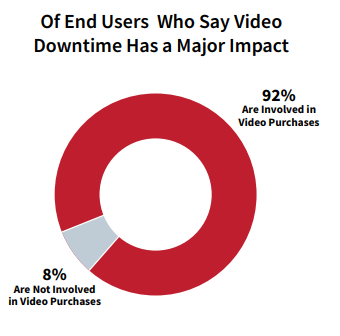

As the purpose and use of video expand beyond original intents, the number of cameras an organization employs has exploded. A single building may have dozens or hundreds of cameras. Inevitably, there are times when cameras go down for technical or mechanical reasons. This downtime has an effect on an organization’s ability to do things like conduct thorough investigations or monitor operations. Respondents to the survey were equally split – half saying video surveillance downtime had a major impact, and half saying it had only a minor impact. However, digging into those numbers, those who know the most about how video is used in an organization tell a different story. More than 90 percent of end users who are involved in the purchasing of video surveillance equipment said that downtime has a major impact on their organizations.

“Cameras being down can be very serious,” said Cargill’s Martin, “We have so many operations tied to video surveillance in certain plants that if the cameras are down for more than two hours we have to shut the plant down.”

The Univeristy of Phoenix’s Lindsey said, “It’s a kind of Murphy’s Law. If you’re trying to investigate something, it’s bound to happen when the cameras were down. So you have to be really vigilant in minimizing your downtime.” He also noted there are potential legal issues, as well. “Once deployed, there is the expectation that they are operational. Failure to repair them when they need it suggests negligence on your part,” he added.

Of End Users Who Say Video Downtime Has a Major Impact

One director of security at a large Texas health system with thousands of cameras noted that having operational cameras is considered mission critical. “Once a week we check every camera. If it’s down, we put a ticket on it to get it repaired or replaced. If it’s down, we have to shroud it. It’s a constant issue. We were an early adopter of camera systems, so we have some older systems in some buildings, some of them still running on DVRs. It can be hard to get doctors’ offices to pay to replace cameras, so we wait for failures and stick NVRs into them when they do.”

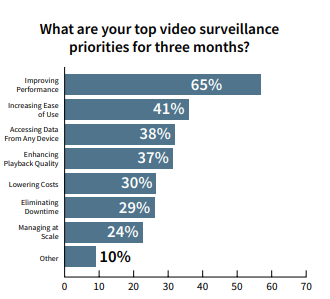

Video surveillance priorities

Survey respondents were asked to select up to three top video surveillance priorities for the next three months from a variety of choices. ‘Improving performance’ was the only selection that was a top-three choice of more than half of the respondents – in fact, nearly two-thirds (65%) said it was a top priority. There were six other choices, and responses ranged from a low of 24 percent for ‘managing at scale’ to a high of 41 percent for ‘increasing ease of use.’ Of the nearly 50 respondents who chose ‘other,’ several mentioned adding or upgrading cameras, which was also what many respondents had in mind when answering ‘improving performance.’

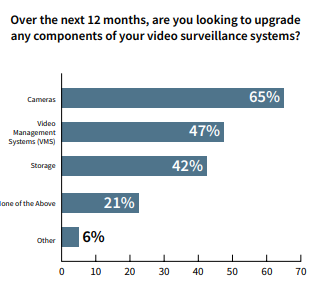

Overall, when asked if they were looking to upgrade cameras, nearly two-thirds (65%) reported that they were. Almost half (47%) said that they intended to upgrade their video management system and 42 percent said they intended to upgrade storage. Of those who noted that they had other upgrade priorities, many of them said they were replacing their entire video surveillance systems with new ones. A few noted that they were seeking to incorporate more artificial intelligence capabilities.

Indeed, analytical capabilities are the exciting new horizon for security directors in charge of the video surveillance system. “What I saw at the ASIS show in September is that an operator can be looking at a video of a suspect, identify the suspect, and the system is smart enough to know if the suspect is walking, running or driving a car, and to know where the suspect is heading and automatically queue up the next video when the suspect appears in it,” added Lindsey.

“As a global company, data privacy has to be on everybody’s mind, especially if you’re operating in the EU,” Martin added referencing the European Union’s General Data Protection Regulation, “It has some specific guidelines related to CCTV. You have to be able to tell people why you’re using it. You have to really understand your camera views. If you can’t explain why they are necessary, you can be liable, and you have to be able to provide access to the data that is collected if someone requests it.”

Storing a massive amount of data

Even compressed video files are storage hogs. The price of memory storage has and continues to drop to the point that even in the world of big data, it is rarely much of a concern. For surveillance video, however, it is still a significant factor to consider. It’s not just the sheer number of bytes it consumes but what it’s being able to access quickly.

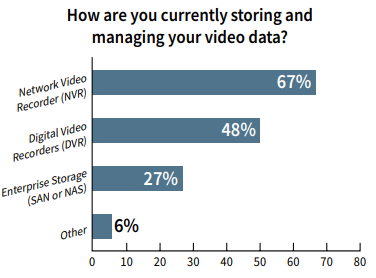

Of those who knew how they stored and managed video, two-thirds reported that they used network video recorders (NVRs), just under half (48%) use digital video recorders (DVRs), and just over a quarter (27%) reported using enterprise storage (SAN or NAS).

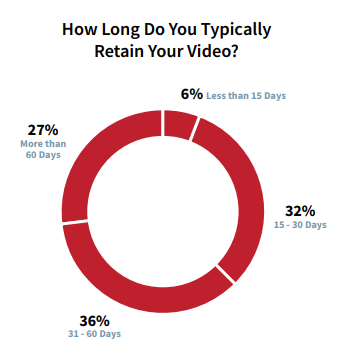

The vast majority of organizations save their videos for longer than 15 days, with just how long split fairly evenly between 15 to 30 days, 31 to 60 days, and longer than 60 days.

As for the amount of video data, almost a quarter (24%) store less than10 terabytes. Almost one-third (32%) store 11 to100 terabytes while 10 percent store more than 1 petabyte, with the rest falling between the two. Not surprisingly, size of the firm is an indicator of how much video storage an organization uses – nearly half (48%) of those who keep more than a petabyte of video storage come from organizations with more than100,000 employees.

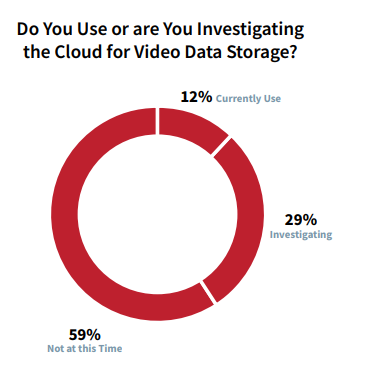

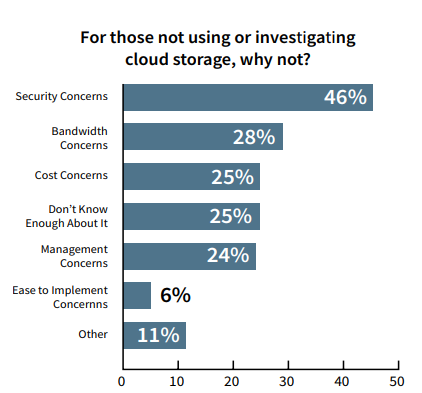

Use and attitudes of cloud storage

Most respondents (59%) reported that they do not use and do not have plans to investigate using the cloud for their video storage needs. Asked to choose why they did not have an interest in using the cloud, ‘security concerns’ topped the list by a wide margin at 46 percent. Approximately one-quarter of respondents chose each of the other choices – bandwidth concerns (28%), cost concerns (25%), do not know enough about using the cloud (25%), and management concerns (24%).

For the large health facility security director, the move to the cloud can’t come soon enough. “I’m hoping to see more and more cloud storage. That’s the way things are going. I’ve got guys in the field on ladders with screwdrivers. I have to have a team just to maintain all the different servers. It’s all too constant and cloud storage would alleviate a lot of that pressure,” added Director of Security at the Texas health system.

Conclusion

As evidenced by the extensive survey of security professionals, the demand for and importance of video surveillance to commercial, government and institutional users is at an all-time high. The survey responses clearly showed that system downtime and data loss result in significant financial, operational and/ or regulatory impacts on their organizations. Additionally, the continuous advancements in technology such as artificial intelligence and ultra-high resolution cameras are driving the need for ever-increasing performance, storage and scalability as needs change over time.

This evolution of technology and the value of video puts tremendous strain on the compute, storage and networking infrastructure underlying all of these systems, making them more vulnerable to major hardware failures that lead to downtime and data loss and increase an organizations’ overall risk; and unfortunately the vast majority of IT infrastructure technology was not designed to handle the unique nuances of large-scale video surveillance applications.

Pivot3 has developed patented solutions that take advantage of the most innovative and disruptive IT datacenter technology – hyper-converged infrastructure – and adapt them specifically for mission-critical video surveillance deployments. The result is highly advanced enterprise-class infrastructure that virtually eliminates downtime and data loss during major hardware failures, and maximizes performance and scalability specifically for video surveillance workloads. All of this value – that cannot be realistically obtained with standards NVRs – is delivered without the cost, complexity, or need for advanced IT skills required by most enterprise infrastructure solutions.