ATM skimming is widespread in the US and is spreading across the world. This technique employs a fake device placed over the ATM keyboard which records the bank account information and the PIN number when a debit card is inserted. This technique is also used at PoS venues, gas/ petrol pump stations and alike. These skimming devices have different physical appearances to match the PoS equipment but the underlying technique is the same. The stolen customer bank information is used to make fake cards which are used to commit fraud and empty customers’ bank accounts.

Hundreds of these incidents are being reported per month and there is no easy way of catching the culprits. A camera placed in the vicinity, with skimming detection software, can video tape the incident and generate alerts to the proper authorities. Earlier, the magnetic tape was used within the card which is now being eliminated and is replaced by a chip. This has though drastically reduced the number of fraud cases, but in the case of skimming even the chip card is not so useful.

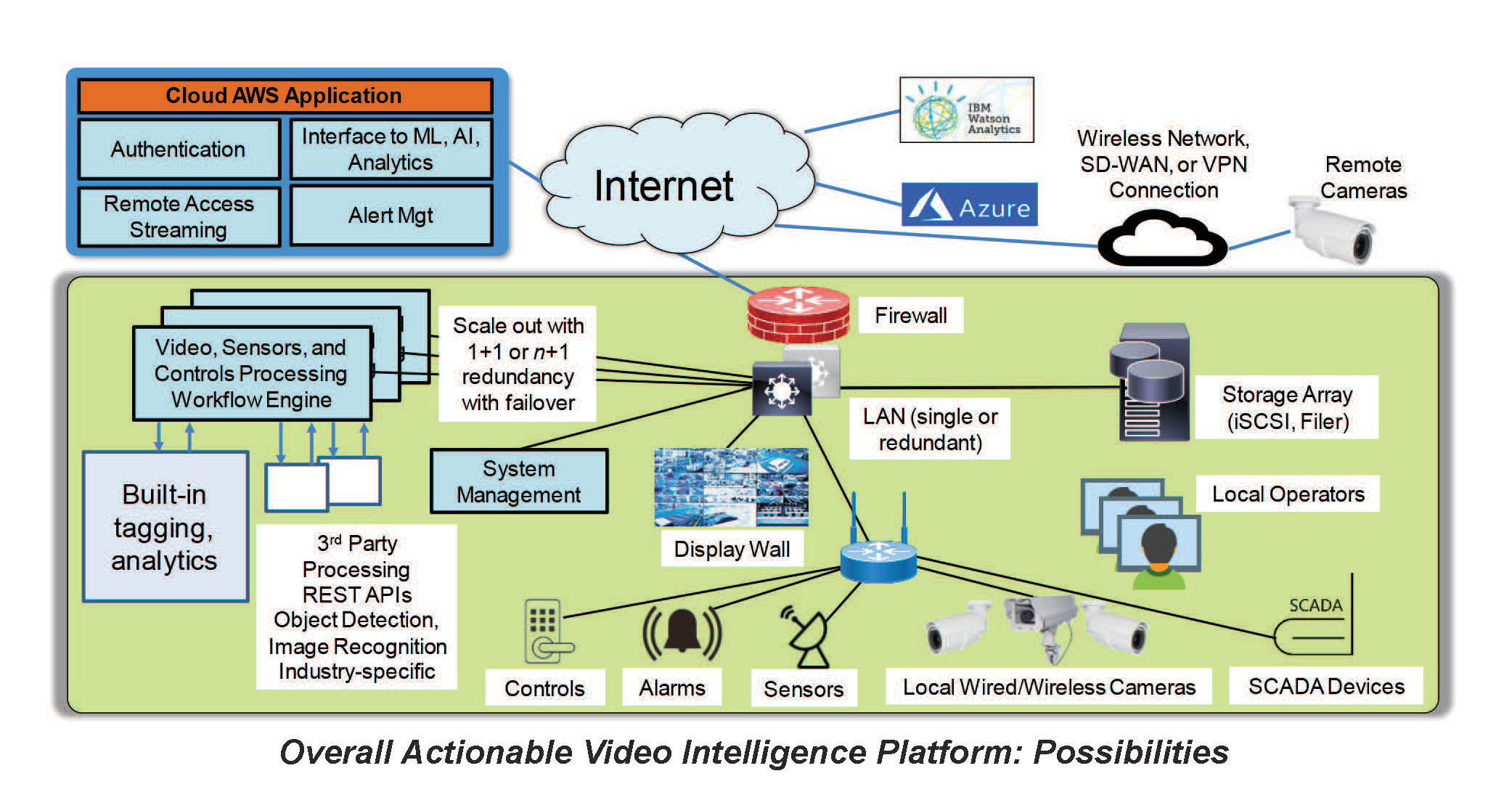

Possibilities

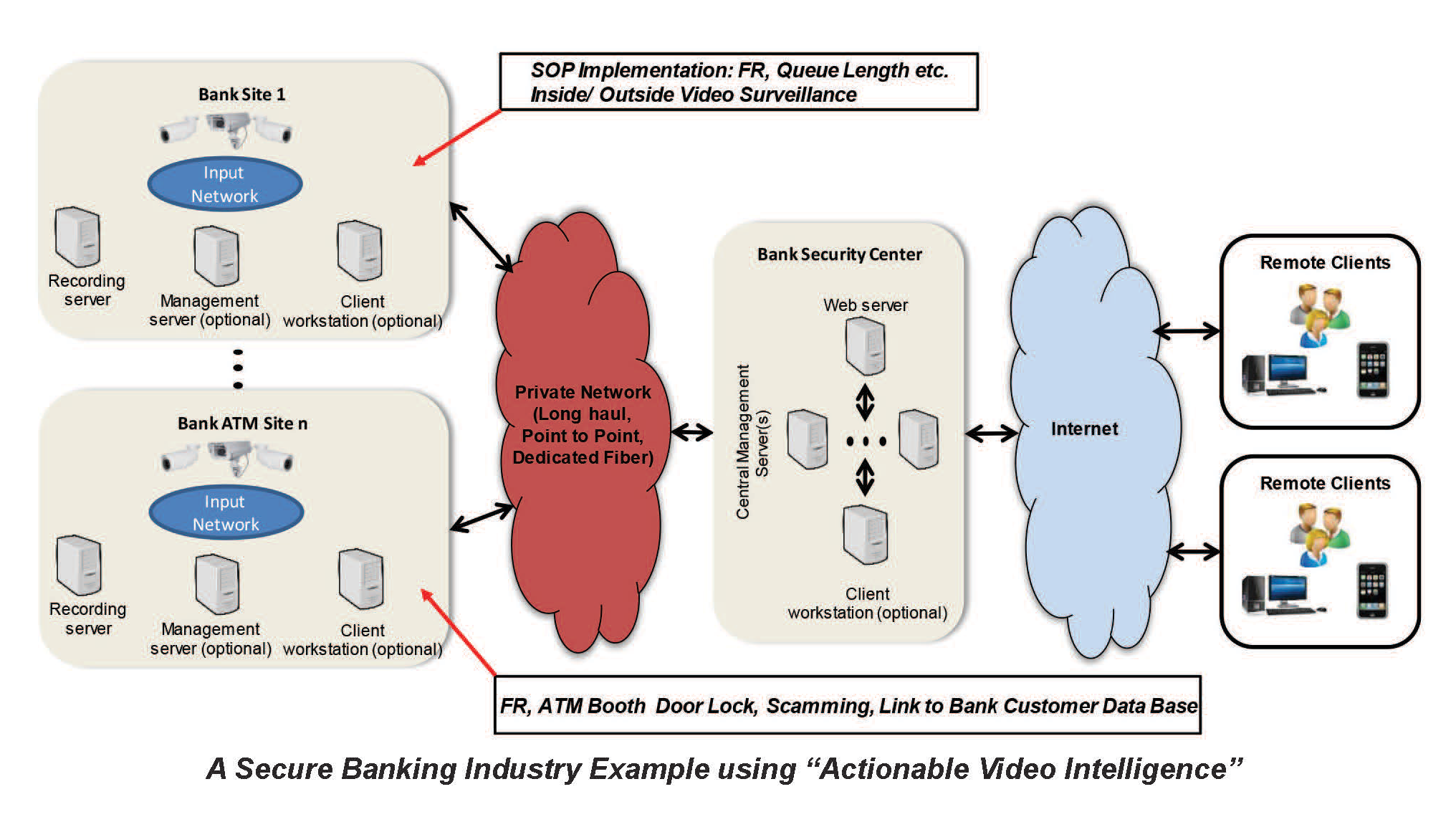

All these scenarios can be dealt in a blow by implementing actionable video intelligence software. Moreover, if every transaction is trapped with a photo of the person plus a small video clip and relayed back to the bank monitoring system, it can alert the bank authorities immediately. In case the bank uses facial recognition, it introduces another level of barrier to committing a fraud by denying the person access to the account as well as locking the door of the ATM booth. There are several possibilities of using proper software that can most likely mitigate/ eliminate fraud across the banking system. Sometimes an USB stick with malware can be inserted into a computer to infect and create havoc in the system.

Skimming is similar because the only point of entry into the secure banking network is the ATM or PoS entity. Banks have their entire network secured, no external access is allowed, plus all point to point communication is encrypted using a 512 bit key AES algorithm. So, the criminals have figured out a weakness in the banking system armor in the form of ATM or PoS, which we believe can be solved by using software.

Challenge

Given all these, video surveillance in traditional sense needs to be and is going through a fundamental transformation with the ongoing advancements in technologies, and it is inevitable. However, these technological advancements are typically resisted by large institutions such as even banks because of the large capital expenditure involved in the transitioning of these traditional systems to modern, scalable and upgradeable future proof ones. Very often this short sighted view comes at a long term cost where both bank customers and the banking industry suffer. The amount of capital lost by the banks and the forfeited customer trust in the banks cannot be easily measured and restored.

Technology trends in video surveillance industry

- Analog cameras are being replaced by the digital/ IP/ network ones to compete the demand of the day.

- Unlike a decade ago when each camera had its own proprietary interface, the interface is now standardized that has lifted the monopoly allowing several players to enter the market.

- NVRs are being replaced by powerful servers which are capable of scaling both by compute as well as storage. This shift was resisted just a decade ago when IT infrastructure personnel resisted moving infrastructure to the cloud. Almost all fortune 500 companies have either moved their IT infrastructure to the cloud or are in the process of doing so today.

- The fastest and most reliable growth in the video surveillance industry is occurring in the area of video software. Video analytics in relation to simple motion detection, line crossing, unattended object and so on, which are performed by almost all vendors, is quickly becoming a technology of the past. The advancement in hardware technology now allows manifold increase in software performance without impacting the incoming video stream. In the past, software algorithm implementation was limited by the available hardware thereby impacting the incoming video stream where frame loss and jitter would compromise the surveillance system. Customers today are demanding sophisticated features and requirements that were not seen in the past.

- Increase in the network speeds over the past decade has been exponential, and that in itself lends to several new and exciting possibilities. For example, in a critical video application, more than one compute node could be processing the same video stream and looking for information that a single node possibly cannot perform. Where do all these lead us to – this question needs to be answered. Below are some of the technology advancements and how the banking industry can benefit from them:

- Actionable video intelligence: Actionable video intelligence is the key phrase that will transform all video applications across all industries.

- Facial recognition: This technology is applicable inside the ATM booth as well as when a customer enters the bank premises. It triggers the need for an overall banking application that ties together several different aspects of banking operations.

- Trapping customer transactions at ATM booth: Transmit customer photo to backend bank database every time an ATM transaction occurs. This will help enabling fraud detection possibilities if several such transactions occur in quick succession at different ATM booths.

- Scamming: Software that detects scamming inside the ATM booth generates an alarm and locks the entry/ exit ATM booth door.

- Non-booth ATM scenarios: Implement ‘loitering’ and ‘crowd detection’ video analytics algorithms within the vicinity of public ATMs and generate alarms, when necessary.

- Monitor bank personnel performance and analytics based on customer queue length: This can be implemented as ‘actionable video intelligence’ to provide feedback to bank management. This is a machine learning and artificial intelligence application that gives management feedback that allows a better satisfiable customer experience by observing real time occurring processes. This will eventually lead to a ‘SoP’ (standard operating procedure) which holds all personnel accountable.

- Monitor inside and outside bank premises using standard PTZ cameras: Adds to overall performance and security of the bank in case of an emergency.

Contributed by PGM Security Group INTL